Traders who use candlesticks may more quickly identify different types of price action that tend to predict reversals or continuations in trends - one of the most difficult aspects of trading. Furthermore, combined with other technical analysis tools, candlestick pattern analysis can be a very useful way to select entry and exit points.

Forex Fibonacci Secret

Forex market being the largest market in the world most closely comes to operating like a huge natural mechanism whose behaviour can be explained by the laws governing other natural phenomena. This is the reason why fibonacci levels work so well on the forex market.

Which Currency News Reports To Trade?

Before we even look at strategies for trading news events, we have to look at which news events are even worth trading.

Remember that we are trading the news because of its ability to increase volatility in the short term, so naturally we would like to only trade news that has the best market moving potential.

While the markets react to most economic news from various countries, the biggest movers and most watched news comes from the U.S.

The reason is that the U.S. has the largest economy in the world and the U.S. Dollar is the world's reserve currency. This means that the U.S. Dollar is a participant in about 90% of all Forex transactions, which makes U.S. news and data important to watch.

With that said, let's take a look at some of the most volatile news for the U.S.

In addition to inflation reports and central bank talks, you should also pay attention to geo-political news such as war, natural disasters, political unrest, and elections. Although these may not have as big an impact as the other news, it's still worth paying attention to them.

Also, keep an eye on moves in the stock market. There are times where sentiment in the equity markets will be the precursor to major moves in the forex market.

Now that we know which news events make the most moves, our next step is to determine which currency pairs are worth trading.

Because news can bring increased volatility in the forex market (and more trading opportunities), it is important that we trade currencies that are liquid. Liquid currency pairs give us a reassurance that our orders will be executed smoothly and without any "hiccups".

- EUR/USD

- GBP/USD

- USD/JPY

- USD/CHF

- USD/CAD

- AUD/USD

These are all major currency pairs!

Remember, because they have the most liquidity, majors pairs usually have the tightest spreads. Since spreads widen when news reports come out, it makes sense to stick with those pairs that have the tightest spreads to begin with.

How to Trade Forex News?

Why Trade the News

The simple answer to that question is "To make more money!"

But in all seriousness, trading the news gives us another opportunity to trade the forex market. As we learned in the previous section, news is a very important part to the market because it's what makes it move!

When news comes out, especially important news that everyone is watching, you can expect to see some major movement. Your goal as a trader is to get on the right side of the move, but the fact that you know the market will indeed move somewhere makes it an opportunity definitely worth looking at.

Dangers of trading the news

As with any trading strategy, there are always possible dangers that you should be aware of.

Here are some of those dangers:

Because the market is very volatile during important news events, many dealers widen the spread during these times. This increases trading costs and could hurt your bottom line.

You could also get "locked out" which means that your trade could be executed at the right time but may not show up in your trading station for a few minutes. Obviously this is bad for you because you won't be able to make any adjustments if the trade moves against you!

Imagine thinking you didn't get triggered, so you try to enter at market... then you realize that your original ordered got triggered! You'd be risking twice as much now!

You could also experience slippage. Slippage occurs when you wish to enter the market at a certain price, but due to the extreme volatility during these events, you actually get filled at a far different price.

Big market moves made by news events often don't move in one direction. Often times the market may start off flying in one direction, only to be whipsawed back in the other direction. Trying to find the right direction can sometimes be a headache!

Profitable as it may be, trading the news isn't as easy as beating Pipcrawler on Call of Duty. It will take tons of practice, practice and you guessed it... more practice! Most importantly, you must ALWAYS have a plan in place. In the following lessons, we'll give you some tips on how to trade news reports.

What are the Japanese Candlesticks?

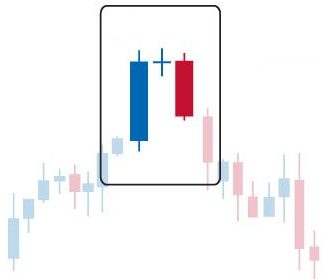

Candlesticks provide unique visual cues that make reading price action easier. Trading with Japanese Candle Charts allow speculators to better comprehend market sentiment. Offering a greater depth of information than traditional bar charts - where the high and low are emphasized - candlesticks give emphasis to the relationship between close price and open price.

Traders who use candlesticks may more quickly identify different types of price action that tend to predict reversals or continuations in trends - one of the most difficult aspects of trading. Furthermore, combined with other technical analysis tools, candlestick pattern analysis can be a very useful way to select entry and exit points.

The body of a candlestick illustrates the difference between the open and closing price. Its color (in this case, red for down and blue for up) shows whether the day's (or week's or year's) market closed up or down.

The wicks (or shadows) point out the extreme low and the extreme high price for the currency that day.

Bar-Chart Side by Side With Candlestick Chart

Because the body of the candle is thicker than the shadow, candlestick charts visually stress how the close price relates to the open price far more than bar charts. Candlestick traders have a saying; the real body is the essence of price movement.

Bar charts on the other hand allow spikes to highs and lows to have prominence when exploring their data, these highs and lows often represent market noise, less significant to good analysis. The power of candles is their ability to visually screen out this static and focus on what the market was able force price to do during a period of trading

Outside of the trading pit, Technical Analysis is really the only way to gauge market emotion. A candlestick alone does not give much information useful to determining market sentiment. Market professionals do however look for specific patterns of candlesticks to gauge future price movements. Many of these candlestick names have eccentric names like Morning Star, Dark Cloud Cover or Engulfing Pattern that are based translations of their Japanese names. The names also tend to reflect market sentiment.

Bearish Reversal Pattern

One of the most significant goals of technical analysis is to identify changes in direction of price action. Because candlesticks give insight into what the market is thinking, one of the most useful aspects of candlestick analysis is its ability to suggest changes in the sentiment of the market. We call these candle formations Reversal Patterns.

There are a number reversal patterns in western technical analysis, such as Head & Shoulders and Double Tops. Those formations often don't give much insight into what the market is thinking, they simply represent common patterns found in price action that precede a reversal. Reversal patterns in western analysis often take many periods to form. On the other hand Candlestick interpretations concentrate much more on understanding market psychology than anything else. And because the vast majority of Candlesticks formations take one to three time periods, they give traders more of a real time picture of market sentiment.

Important to note is that with candlesticks a reversal pattern does not necessarily suggest a complete reversal in trend, but merely a change or pause in direction. That could mean anything from a slowdown in trend, sideways trading after an established trend, or a full turnaround following a reversal candle pattern.

Continuation Pattern

Continuation patterns suggest the market will maintain an established trend. Often the direction of the candlesticks themselves are in the opposite direction of trend in continuance. Continuation patterns help traders differentiate between a price action that is in full reversal and those merely taking a pause. Most traders will tell you there is a time to trade and a time to rest. The formation of continuation candlestick patterns imply consolidation, a time to rest and watch.

Bullish Reversal Pattern

One of the most significant goals of technical analysis is to identify changes in direction of price action. Because candlesticks give visual insight into what the market is market psychology, one of the most useful aspects of candlestick analysis is its ability to suggest changes in the sentiment of the market, and reversals in trend. We call these candle formations Reversal Patterns.

Important to note is that with candlesticks a reversal pattern does not necessarily suggest a complete reversal in trend, but merely a change or pause in direction. That could mean anything from a slowdown in trend, sideways trading after an established trend, or a full turnaround following a reversal candle pattern.

Using Candlesticks

Candlesticks serve as valuable insight into the market. Most candlestick analysts will tell you though; do not to use them as your sole technical analysis tool. These patterns are often made irrelevant by technical analysis events outside of what candle formations can tell you. The most prominent candlestick analysis proponents in the West use these patterns to confirm traditional western technical or fundamental analysis techniques.

View All Candlesticks Patterns here..

View All Candlesticks Patterns here..

Forex Strategies To Better Gains

Keeping your money at a decent level is the biggest key to success. For example, if you lost 50% of the money in your account, then you would have to make back 100% just to be back at the starting amount. The following are 5 strategies to help you keep your money secure by keeping losses small and running big profits.

To have a successful, effective Forex trading business you need to protect your funds, keep losses as small as possible, and allow big profit trades to run. Even though money management is the key to a profitable business in Forex trading, many traders only think of it last. In this piece we will discuss money management tips that have been successful on many, many occasions.

Make sure to Learn The 80 - 20 Rule

This is a rule used in many facets of daily life. In business sales it is applied as follows: 80% of your profits are made form 20% of your clients. In Forex Trading 80% of your profits come from 20% of your trades. In other words, to be successful and keep your money secure, you need to get rid of the trades that are too risky.

A lot of traders simply make too many trades. The fact is that it is not the number of trades you make that makes you successful, it is the number of times you are right in those trades. By having some patience, you will be able to focus all your funds on trades with high odds and low risks. This allows you to eliminate high potential losers.

There are some traders who simply only trade once a week or even once a month. This style of trading tends to produce triple digit profits. Most traders will prosper by simply learning more is not necessarily better; less is is frequently best.

Be sure to risk amounts that are actually worth something

In order to cover the inevitable small losses, a trader knows he has to risk an amount that will make a difference in his/her account. For example if your risk percentage is 2% and your account is $1,000, then you are only risking $20. Do you really think that is going to make a difference in your account? Now, if you risk 10-20% on high odds trades you have the potential to make a decent profit. The key is to stay strong and don't go against the goals and/or stops you put in place. No, this is not foolhardy. It is simply risking an amount that will be beneficial. Software such as Forex Megadroid and Forex Autopilot give you the option to adjust your risk levels based on your personal comfort levels.

Make sure not to place stops in market noise

Alot of traders believe they can trade using very close stops. They usually place them within the daily fluctuations and tend to lose. If you place stops within the normal daily fluctuations of the market, it may seem as though your risk is low. However, contrary to belief, your odds of getting stopped are very high due to the fact the chance of success is not in your favor.

A lot of traders put so much effort into limiting their risk, that they actually make it worse.

You must place your stop levels outside the daily fluctuation ranges and behind large levels of support or resistance. Yes, this may look like it is a high risk due to your stops may be out of your comfort zone, but the chances of you making a profit are actually increased.

Make sure to view your overall account performance

In other words, if you are doing well, go ahead and risk a larger percentage of your balance. However, if you are doing bad, lower the percentage of money you are risking. To put it in a more understandable comparison, a poker player adjust his/her bet based on the hand he is dealt, so the successful trader varies his percentage to be risked based on odds.

Make sure you let your stops ride for a while

When a profit is made, many traders what to be sure they do not lose it, so they take the actions to prevent any changes in the profit. However, this can be very costly. When in on a big trend, if you make sure you trail stop outside of the normal daily market fluctuations, and accept the smaller short term losses, you will have a bigger profit in the long run.

If you want to win, you have to stay in the game.

Most traders make the common mistakes of trading too much, taking trades with low odds, and risking too little money. These basically set the trader up for failure. The successful trader simply trades less, makes trades with higher odds, and risks a little more of his/her money. These actions increase is chances of making a profit.

Due to the fact that Forex trading is based on taking risks, you have to make risks that will make a difference if you are going to make a decent profit. By failing to follow these strategies, a trader will slowly lose all his/her money and never find the big trend to follow, and will eventually fail completely.

A Forex Trading Plan: Limit Your Greed

I don’t know how long you have been trading forex, but you can be among those traders who have been trying to make a living or at least a supplementary income through forex trading, but have not been successful so far. There are a lot of people who have spent several years to learn forex. They have tried so many systems and strategies but they still lose. They still think that they have not found a good system and their problem is that they don’t have a good trading strategy , but they are wrong. They have had several good systems but they have not been able to make those systems work and make money for them. They know much more than what they should know to be a profitable trader, but they still read and learn more and more and still they think that they have not learned enough.

GREED is the most important reason of their failure. They have not been able to become a profitable forex trader because they are greedy. Because they are not even aware of their greed. It controls them and pushes them to overtrade and take wrong positions, but they don’t know. Greed is a normal emotion that everybody has. If you have not been greedy so far and if you think you are not greedy, just trade forex and see how greedy you are. This is normal. Everybody likes to work less and make more. Everybody likes to become a multi-millionaire or multi-billionaire within the shortest time but the problem is this strong desire can not only prevent you from getting rich, but it doesn’t even let you become a profitable forex trader who is able to make a steady small income every month.

The problem is that sometimes we don’t know what greed is, what it does and how it works. If you overtrade; if you take positions when there is no strong and sharp signal; if you take the position while it is too late and you should wait for another trade setup; if you push yourself to trade every day and when you don’t find a trade setup one day you feel angry, guilty and uncomfortable; if you try to double or triple your account within the shortest time; if you get furious when you see you have missed a good trade setup; if you take too much risk and trade more than 2-4% of your account; if you don’t close a wrong position as soon as you are realized that it was a mistake; if you follow several trading systems and strategies because you want to have as many trade setups as possible every day; if you still look for e-books and articles every day and you read them and follow and try their directions and you are not happy with what you have learned; if you like to trade with small time frames to have more trade setups; if you set a big pip or monetary goal for yourself and you get upset when you can not achieve it… THEN you are not able to control your greed.

I don’t say you are greedy. I say you are not able to control your greed. Because everybody is greedy. The difference is some people are able to control their greed and some people are not.

Maybe many of you, have been trying forex for several months or even a few or few years but have not been profitable so far. You make some profit every now and then and lose it with some bad trades. Let me share a million dollar secret now. It is the right time to do it.

You will become profitable only when you become able to control your greed. You should be able to ignore some positions and signal that don’t look good and strong or you are late and it is not safe to enter. If you review your memory, you will see that most of the bad positions you have taken are because you have not picked a strong signal or because you had missed a strong signal but you pushed yourself to enter and make some profit and get out. But they went against you right after you entered. Maybe they have been waiting for you to enter to change their direction. Sometimes it really looks like that a position has been waiting for you to enter and right when you clicked on buy or sell button, it changed its direction. It is because you are late or you have picked a poor signal.

Being late or picking a poor signal is because of nothing but greed. You can not ignore the money that it may make for you. So you take it. When it comes to trading, everybody becomes greedy. Please don’t get me wrong. I am not criticizing you. This is normal. Everybody likes to work less and make more. I knew myself as someone who could be everything but greedy. But when I started trading, I discovered my greed. It showed up. It is hard to know it first. You have no idea. It pushes and controls you but you don’t feel it. You are not aware of its presence. You will become a profitable trader only when you know it and become able to control it.

Where To Place The Stop Loss?

What is the best place to put the stop loss and limit orders?

Stop loss is a must. You have to have it when you trade even if you are an intraday trader and you sit at the computer and watch the price movement and all your positions are closed at the end of your trading day.

Stop loss position is very important. Sometimes having a tight stop loss will be nothing but a loss because it will be triggered even when you choose the right direction.

Stop loss should be placed in a position that will be triggered only when the direction you have chosen is absolutely wrong. For example the price is going up. You wait for a reversal signal. The price changes its direction and starts going down and you take a short position. So the pick that the price has made before it goes down is a resistance.

Now a question: When you will be realized that taking a short position has been a wrong decision and the price will keep on going up?

Yes; only when it goes up and breaks the resistance. It means it goes up and goes higher than the point that it changed its direction and went down. Otherwise you have chosen the right direction.

So where should you place the stop loss? A few pips above the pick (resistance) plus the spread.

When you take a short position, you have to add the spread to the value of the point that you consider as the stop loss because when you take a short position (you sell) you have to buy to close the position and when you buy you have to pay the spread to the broker. So your stop loss should be a buy order and you have to add the spread to it. This is very important when you trade with the currency pairs that have a high spread. If you don’t do that, your stop loss will be triggered sooner and when the price has not gone over the pick.

But when you take a long position (you buy), you don’t have to add the spread because you paid it when you bought.

Let me shows you some examples.

1. In this example, you take a short position at 211.74. As I explained above, if the price goes up and breaks the resistance, it means the taken position has been a wrong position. The resistance is at 212.39. To place the stop loss, I add 3 to 5 pips to the resistance plus the spread.

So in this case the stop loss will be 212.39 + 5 pips + 8 pips = 212.52

2. In this example you take a long position (you buy) at 214.37. The support is at 213.56 and the stop loss will be 5 pips under the support line which will be 213.61.

3. Now lets say you take a long position at 1.4642 after the triangle breakout. As you see in the below chart a symmetrical triangle is broken up. The big Bullish candlestick is a good confirmation that the triangle resistance is broken and so you take a long position when this candlestick is fully formed. But where should you place the stop loss?

It is always possible that the prices changes the direction to retest the broken support or resistance but if it succeeds to break the support or resistance after retesting, your position should be closed because it is possible that the price keep on moving against your direction.

In this example, your long position should be closed if the price goes down, retests the broken triangle resistance (will act as a support after breaking), breaks it and then keeps on going down. To determine the stop loss position, you have to extend the triangle broken resistance and then find a suitable position under the broken resistance. In this case it is 1.4588.

As you see there is no special rule for stop loss like “your stop loss should be 50 pips under the buy price…”. Stop loss position is different from one trade to another one even with the same currency pair and time frame. Sometimes your stop loss will be 20 pips under your buy price and sometimes it has to be as high as 200 pips.

When you work with bigger time frames you use the above stages to determine your stop loss position but as the bigger time frames have bigger scales, your stop loss value will be much bigger.

Move your stop loss!

When you see that the price moves to your favorite direction and you are making profit, you should cancel your primary stop loss and set anther one, higher than the primary stop loss. For example you have bought EUR-USD at 1.4246 and your primary stop loss is 1.4588. The price goes up for 50 pips. You will have to move your stop loss 50 pips higher which is 1.4638. Then if it kept on going up for 50 pips more, you will have to move your stop loss 50 pips higher than the second stop loss.

This is a good technique to maximize your profit when the price keeps on moving to your direction for a long time. But keep in your mind that it doesn’t mean that you have to wait until the price hits your stop loss. To protect your profit, when you see a clear reversal signal, you should close your position immediately and before it hits your stop loss.

50 pips in this example is just an example and is not a rule that has to be obeyed in all trades. It depends on the conditions and trade. For example when you just open a position at the beginning of a candlestick, you have to wait for the candlestick to be formed completely and then decide if you want to move your stop loss or not. You don’t move your stop loss immediately when the price moves to your direction.

Ok! Hope the above explanations were clear enough and you learned how to set your stop loss. In case you have any question, just leave a comment and I will get back to you shortly.

How about limit?

Limit is a good thing to fix your profit before you lose it and of course it is a good thing to limit and control your greed. It is better to keep a trade as long as it is moving to the favorite direction and there is no reversal signal but you can set a limit and fix your profit. You should not get upset if the price keeps on moving to the same direction for several hundreds of pips after hitting your limit. You are already out of the game.

Determining the limit can be very easy if you make a rule for yourself. For example you say “I will be happy with 20 pips and want my position to be closed when I have made it”. But it can be hard and complicated if you want to determine the final destination of the price and set your limit according to it. It is always possible that the price doesn’t move according to your predictions and so it changes its direction before hitting your limit. So you have to be careful.

If you like to earn the maximum profit, you have to determine the final destination of a trend. This can be challenging. First you have to find all the supports and resistances. You have to use the Fibonacci levels in the best way. When you have a long position, any of the Fibonacci levels can reverse the price and so they can be your limit.

The only case that is easy to determine the limit is trading a channel which is when the price is moving inside a channel and goes up and down between a support and resistance line. But even in this case, sometime the price changes its direction before it hits the limit.

What is OCO?

OCO stands for One Cancel Other. An OCO order includes a stop loss and a limit order. Any of them that becomes triggered, the other one will be cancelled automatically and so it will not be triggered later.

The last thing I want to say is that keep in your mind that you MUST cancel all the pending orders including stop loss and limit when one of them is triggered or you have closed your trade by yourself otherwise you will be in trouble because they will be triggered when you have no position and you are not at the computer and so they will open a new position and you don’t know where the price will move. It can be ended to big losses. I have lost a lot of money because of this stupid mistake. So be careful.

Do Not Trade Without Stop Loss

Trading without stop loss is the biggest mistake a trader can make. This is what you read on any website, weblog, article, e-book and... Although they do know that this is a big mistake, almost all novice traders make this mistake at least once. Most of them repeat this mistake for a few times and they wake up when they have already blown up a few accounts. Most of them give up for good because they have no money to trade anymore or they are emotionally hurt and they do not dare to try Forex trading anymore. Some of them do not like to give up because they still think that Forex can make money for them, but they become skeptical if it is really possible to make money through forex trading or not.

Stop loss is the most important thing in trading. It does not let an ordinary trading mistake become a disaster and trauma. So never even think about trading without setting a proper and reasonable stop loss.

If you always trade with a proper stop loss and you follow the money management rules, you will never give up on Forex trading and you will become a profitable Forex trader finally. This is the Forex trading top secret. The Forex key secret is not a special trading system that makes you a multimillionaire within a very short time. There is no such a system. The Forex trading key secret is in money management and stop loss setting.

You take a position without any stop loss or you initially set a stop loss, but you remove it when it is about to be triggered. You do not want to end a trade with a loss and so you remove your stop loss and you think it will move to your direction and you will have the chance to get out at breakeven. Now your position is 400 pips against you and you don’t know what to do. Sometimes you decide to close it, but as soon as you want to do it your inner demon says “what if it moves to your direction after you close it with a 400 pips loss?”. So you don’t close the position and you decide to wait more. Finally you get out of the trade because there is no more money in your account. You get margin call and your position will be closed automatically.

Some traders blow up their accounts several times just because when they want to close a losing trade something whispers that “what if it turns around after you close it?”. They don’t close their trades and they let their account to be wiped out just because it is too hard for them to see the market turns around after they get out of a losing trade. Maybe they have already experienced that if they had not closed a losing trade, they could have the chance to get out at breakeven or even with some profit. So they decide not to close their losing positions and wait for them to turn around.

Now the question is what happens if the market turns around and moves toward your target after you close your losing position or after hitting your stop loss? Nothing important and critical happens. You just lose some money. But what happens if you don’t close your losing position and it keeps on moving against you? You lose all the money you have in your account. Believe it or not, but I have seen someone who lost 7 million dollars because of the same stupid mistake. I still have his statements. He took a position without setting a stop loss. It went against him very badly. He hold the position and then added to his wrong position (averaging down) which is even a bigger mistake than trading without stop loss. After a while he had four 200 lots losing positions all against him and finally he lost all he had in his account. He lost all he had just because he did not want to have a losing trade or he also did not like to see the market turns around and leaves him a losing trade, after closing his losing position.

In contrast, there is another trader, Dan Zanger, who turned 10,000 dollars into 42 million in 23 months. Do you think he doesn’t have any losing trade at all? Of course he does, but he lets a wrong position be closed by a proper stop loss. He could not make 42 millions dollars if he had got married with a losing trade and let it drain all the money he had in his account.

What should you do if you make such a mistake?

If you have taken a position and it is moving against you while you have no stop loss, you should close it as soon as possible. Ask yourself where the stop loss of such a trade should have been placed. Then if the price has not reached the stop loss position yet, set your stop loss immediately. If the price is beyond the stop loss, then close your position immediately. Yes, it is possible that the market turns around as soon as you get out, but it is ok. You never know. You can still trade and recover your loss if there is some money left in your account. But if you lose all your money, you may not be able to trade anymore.

I have seen some traders who check the bigger time frames when their positions go against them. They trade intra-daily using a small time frame like 15min, but when their positions go against them, they check the bigger time frames like one hours or 4hrs and convince themselves that although the position (which has been taken based on the 15min chart) is against them, the one hour and 4hrs charts are in the right direction and they can get out without any loss very soon. Then when the market keeps on moving against them, they refer to daily and weekly charts. Someone who wanted to be an intraday trader, becomes a swing trader. A 15min position which can not lose more than 50 to 80 pips maximum (depend on the currency pair), is now 500 pips in loss. If your position is taken based on a special time frame and it is against you, you should close it based on the same time frame. You should not hold it just because the bigger time frames show some agreeable signals. If the time frame that you took your position based on, has changed the direction and is completely against you, you should be OUT as soon as possible.

You Are Either Right or You Should Be Out!

The bottom line is do not trade without stop loss. Enter the stop loss value before you click on the buy/sell button. Do not set the stop loss after taking the position. Set the stop loss at the same time, because you may not be able to edit your position and set the stop loss later.

Subscribe to:

Comments (Atom)