Candlesticks provide unique visual cues that make reading price action easier. Trading with Japanese Candle Charts allow speculators to better comprehend market sentiment. Offering a greater depth of information than traditional bar charts - where the high and low are emphasized - candlesticks give emphasis to the relationship between close price and open price.

Traders who use candlesticks may more quickly identify different types of price action that tend to predict reversals or continuations in trends - one of the most difficult aspects of trading. Furthermore, combined with other technical analysis tools, candlestick pattern analysis can be a very useful way to select entry and exit points.

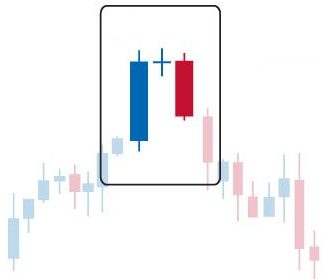

The body of a candlestick illustrates the difference between the open and closing price. Its color (in this case, red for down and blue for up) shows whether the day's (or week's or year's) market closed up or down.

The wicks (or shadows) point out the extreme low and the extreme high price for the currency that day.

Bar-Chart Side by Side With Candlestick Chart

Because the body of the candle is thicker than the shadow, candlestick charts visually stress how the close price relates to the open price far more than bar charts. Candlestick traders have a saying; the real body is the essence of price movement.

Bar charts on the other hand allow spikes to highs and lows to have prominence when exploring their data, these highs and lows often represent market noise, less significant to good analysis. The power of candles is their ability to visually screen out this static and focus on what the market was able force price to do during a period of trading

Outside of the trading pit, Technical Analysis is really the only way to gauge market emotion. A candlestick alone does not give much information useful to determining market sentiment. Market professionals do however look for specific patterns of candlesticks to gauge future price movements. Many of these candlestick names have eccentric names like Morning Star, Dark Cloud Cover or Engulfing Pattern that are based translations of their Japanese names. The names also tend to reflect market sentiment.

Bearish Reversal Pattern

One of the most significant goals of technical analysis is to identify changes in direction of price action. Because candlesticks give insight into what the market is thinking, one of the most useful aspects of candlestick analysis is its ability to suggest changes in the sentiment of the market. We call these candle formations Reversal Patterns.

There are a number reversal patterns in western technical analysis, such as Head & Shoulders and Double Tops. Those formations often don't give much insight into what the market is thinking, they simply represent common patterns found in price action that precede a reversal. Reversal patterns in western analysis often take many periods to form. On the other hand Candlestick interpretations concentrate much more on understanding market psychology than anything else. And because the vast majority of Candlesticks formations take one to three time periods, they give traders more of a real time picture of market sentiment.

Important to note is that with candlesticks a reversal pattern does not necessarily suggest a complete reversal in trend, but merely a change or pause in direction. That could mean anything from a slowdown in trend, sideways trading after an established trend, or a full turnaround following a reversal candle pattern.

Continuation Pattern

Continuation patterns suggest the market will maintain an established trend. Often the direction of the candlesticks themselves are in the opposite direction of trend in continuance. Continuation patterns help traders differentiate between a price action that is in full reversal and those merely taking a pause. Most traders will tell you there is a time to trade and a time to rest. The formation of continuation candlestick patterns imply consolidation, a time to rest and watch.

Bullish Reversal Pattern

One of the most significant goals of technical analysis is to identify changes in direction of price action. Because candlesticks give visual insight into what the market is market psychology, one of the most useful aspects of candlestick analysis is its ability to suggest changes in the sentiment of the market, and reversals in trend. We call these candle formations Reversal Patterns.

Important to note is that with candlesticks a reversal pattern does not necessarily suggest a complete reversal in trend, but merely a change or pause in direction. That could mean anything from a slowdown in trend, sideways trading after an established trend, or a full turnaround following a reversal candle pattern.

Using Candlesticks

Candlesticks serve as valuable insight into the market. Most candlestick analysts will tell you though; do not to use them as your sole technical analysis tool. These patterns are often made irrelevant by technical analysis events outside of what candle formations can tell you. The most prominent candlestick analysis proponents in the West use these patterns to confirm traditional western technical or fundamental analysis techniques.

View All Candlesticks Patterns here..

View All Candlesticks Patterns here..

0 comments:

Post a Comment